Navigating entrepreneurial success requires a well-defined roadmap; these guides offer free templates in PDF, Word, and Excel formats, aiding structure and clarity․

Business plans are essential planning tools, empowering entrepreneurs to meticulously organize and present their ventures, ensuring a focused and strategic approach․

What is a Business Plan?

A business plan is a formal written document containing the goals of a business, the methods for attaining those goals, and the time-frame for achieving them․ It serves as a blueprint for success, detailing a company’s objectives and how it intends to reach them․

Essentially, it’s a comprehensive overview of your business, covering aspects like financial projections, market analysis, and organizational structure․ These plans aren’t static; they’re living documents, evolving with the business․ Utilizing free templates in formats like Word and Excel streamlines the creation process, offering a structured framework for entrepreneurs to articulate their vision and strategy;

It’s a crucial tool for securing funding and guiding operational decisions․

Why You Need a Business Plan

A well-crafted business plan is paramount for several reasons․ Firstly, it forces you to thoroughly analyze your business idea, identifying potential challenges and opportunities․ Secondly, it’s essential for securing funding from investors or lenders, demonstrating viability and potential returns․

Furthermore, a plan provides a clear roadmap for your business, guiding decision-making and ensuring everyone is aligned with the overall strategy․ Utilizing free templates – available in PDF, Word, and Excel – simplifies this process, providing a structured approach․

Without a plan, businesses often lack direction and are more prone to failure․

Types of Business Plans (Lean Startup, Traditional)

Two primary business plan approaches exist: the traditional and the Lean Startup․ Traditional plans are comprehensive, detailed documents often required by investors, covering all aspects of the business․ Conversely, the Lean Startup plan focuses on rapid experimentation and iterative development․

Lean plans utilize a “build-measure-learn” cycle, prioritizing speed and adaptability․ Free templates can assist in creating either type, though Lean templates emphasize concise summaries and key metrics․

Choosing the right approach depends on your business stage and funding needs; both require careful planning and analysis;

Executive Summary

A compelling executive summary is crucial; it concisely presents your business concept, highlights key financials, and secures reader interest for further review․

The Importance of a Compelling Executive Summary

The executive summary serves as a first impression, often the sole document potential investors or lenders will initially review․ Its power lies in conciseness and clarity, encapsulating the entire business plan into a digestible format․ A well-crafted summary immediately grabs attention, showcasing the venture’s potential and viability․

It must articulate the core business concept, target market, competitive advantages, and financial projections with precision․ A weak or poorly written summary can lead to immediate dismissal, regardless of the underlying strength of the business․ Therefore, dedicating significant effort to its creation is paramount for securing funding or gaining stakeholder buy-in․

Key Elements of an Executive Summary

A robust executive summary typically includes a concise company description, outlining the business’s mission and value proposition․ Crucially, it highlights the problem being solved and the proposed solution, demonstrating market need․ Financial highlights, such as projected revenue and profitability, are essential, alongside funding requests if applicable․

The summary should also detail the target market and competitive landscape, showcasing a clear understanding of the industry․ Finally, a brief overview of the management team and their expertise builds confidence․ These elements, presented succinctly, create a compelling narrative that entices readers to delve deeper into the full business plan․

Company Description

Clearly define your business, outlining its mission, vision, and structure․ Detail ownership and address all relevant legal considerations for a solid foundation․

Mission Statement and Vision

Crafting a compelling mission statement is paramount; it succinctly defines your company’s purpose and core values, guiding daily operations and long-term goals․ This statement should articulate what you do, who you serve, and how you deliver value․

Complement this with a visionary statement, painting a picture of your desired future state․ This aspirational declaration outlines where you aim to be in the long run, inspiring stakeholders and providing a clear direction for growth․ Both statements should be concise, memorable, and reflective of your company’s identity․

Ensure alignment between your mission and vision, creating a cohesive narrative that resonates with employees, investors, and customers alike․

Company Structure and Ownership

Clearly define your company’s legal structure – sole proprietorship, partnership, LLC, or corporation – as this impacts liability, taxation, and administrative requirements․ Detail the ownership distribution, specifying percentages held by each stakeholder․

Outline the organizational hierarchy, illustrating reporting lines and key personnel roles․ A visual organizational chart can be highly effective․ Specify decision-making processes and the level of authority vested in each position․

Transparency is crucial; accurately represent ownership and structure to build trust with investors and demonstrate a well-governed organization․ This section establishes credibility and clarifies internal dynamics․

Legal Considerations

Address all relevant legal aspects of your business, including permits, licenses, and zoning regulations required for operation․ Detail any intellectual property protection – patents, trademarks, copyrights – safeguarding your unique offerings․

Outline compliance with industry-specific regulations, such as health and safety standards or data privacy laws․ Include information on insurance coverage, mitigating potential risks and liabilities;

Consult with legal counsel to ensure comprehensive coverage and adherence to all applicable laws․ This demonstrates due diligence and protects your business from potential legal challenges, fostering long-term sustainability․

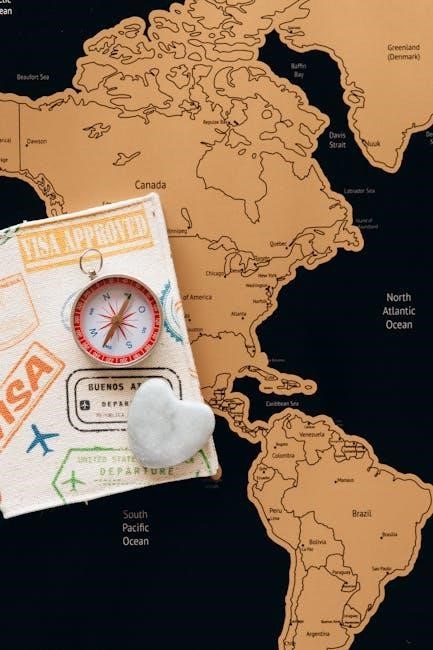

Market Analysis

Thoroughly investigate your target market, analyze competitors, and identify emerging trends to assess growth potential and ensure a viable business strategy․

Target Market Identification

Precisely defining your ideal customer is paramount․ This involves detailed demographic analysis – age, income, location, education – alongside psychographic profiling, understanding their values, lifestyles, and purchasing behaviors․

Consider needs and pain points your product or service addresses․ Market segmentation allows tailoring marketing efforts for maximum impact․ Research existing data, conduct surveys, and analyze competitor customer bases․

A clearly defined target market minimizes wasted resources and maximizes return on investment․ It informs product development, pricing strategies, and overall business direction, ensuring alignment with customer demand․

Competitive Analysis

Thoroughly assess your competitors – direct and indirect – identifying their strengths, weaknesses, market share, pricing, and marketing strategies․ Analyze their products, services, and customer reviews to pinpoint opportunities for differentiation․

Evaluate competitive advantages; what makes your offering unique? Consider factors like cost leadership, product innovation, customer service, or niche specialization․ A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is invaluable․

Understanding the competitive landscape allows you to position your business effectively, anticipate market changes, and develop strategies to gain a competitive edge and secure long-term success․

Market Trends and Growth Potential

Identify current and emerging market trends impacting your industry․ Research technological advancements, shifting consumer preferences, and regulatory changes․ Analyze market size, growth rate, and potential for expansion․

Assess the overall growth potential of your target market․ Consider factors like demographic shifts, economic conditions, and industry forecasts․ Demonstrate a clear understanding of market dynamics and future opportunities․

Highlight potential challenges and risks, alongside growth prospects․ A realistic assessment of market trends and growth potential builds investor confidence and informs strategic decision-making․

Organization and Management

Clearly define your organizational structure and key management roles․ Detail team expertise and responsibilities, showcasing a capable leadership team for success․

Organizational Structure

Detailing your company’s organizational structure is crucial for investors and internal clarity․ Begin with an organizational chart visually representing reporting relationships and departmental hierarchies․

Clearly define each role’s responsibilities and authority within the company․ Specify whether the structure is hierarchical, flat, or matrix-based, justifying the chosen model․

Outline key departments – such as marketing, sales, operations, and finance – and their interdependencies․ Address how communication will flow between departments and levels of management․

Include information on advisory boards or consultants, if applicable, and their roles in guiding the company․ A well-defined structure demonstrates preparedness and efficient operation․

Management Team Profiles

Showcase the expertise driving your venture with detailed management team profiles․ Include resumes or concise biographies highlighting relevant experience, skills, and accomplishments for each key member․

Focus on experience directly applicable to the business, emphasizing leadership roles and successful project completions․ Detail educational backgrounds and any specialized certifications or training․

Highlight each individual’s contribution to the company’s success and their specific responsibilities․ Address any gaps in expertise and how they will be addressed, perhaps through advisors or future hires․

A strong management team inspires confidence in investors and demonstrates the capability to execute the business plan effectively․

Service or Product Line

Clearly define your offerings, detailing features and benefits․ Highlight competitive advantages, explaining what makes your products or services unique and valuable to customers․

Detailed Description of Offerings

This section requires a comprehensive overview of your products or services․ Describe each offering in detail, specifying its features, functionality, and benefits to the customer․ Explain how each item addresses a specific market need or solves a problem․

Include technical specifications where relevant, and clearly articulate the value proposition․ Detail any intellectual property, patents, or unique aspects of your offerings․ Consider using visuals, such as images or diagrams, to enhance understanding․ Focus on what differentiates your offerings from competitors, emphasizing quality, innovation, or cost-effectiveness․

Be precise and avoid jargon, ensuring clarity for potential investors or stakeholders․

Competitive Advantages

Identifying and articulating your competitive advantages is crucial․ What sets your business apart from rivals? Detail unique aspects like proprietary technology, specialized expertise, or a strong brand reputation․ Consider cost advantages – can you offer similar products/services at a lower price?

Focus on superior customer service, innovative features, or a niche market focus․ Analyze competitor weaknesses and how you exploit them․ Highlight barriers to entry, making it difficult for others to replicate your success․ Clearly demonstrate sustainable advantages, not easily copied․

Quantify these advantages whenever possible, showcasing measurable benefits․

Marketing and Sales Strategy

Develop a comprehensive marketing plan outlining strategies to reach your target audience․ Detail sales channels and tactics for converting leads into paying customers effectively․

Marketing Plan Overview

A robust marketing plan is crucial for outlining how your business will reach its target market and achieve sales objectives․ This section should detail your overall marketing strategy, encompassing branding, advertising, public relations, and content marketing initiatives․

Clearly define your marketing budget and allocate resources effectively across different channels․ Identify key performance indicators (KPIs) to measure the success of your marketing efforts, such as website traffic, lead generation, and conversion rates․ Consider both online and offline marketing tactics, tailoring your approach to your target audience’s preferences and behaviors․

Remember to analyze your competitors’ marketing strategies to identify opportunities and differentiate your brand․ A well-defined marketing plan provides a roadmap for attracting customers and driving revenue growth․

Sales Strategy and Channels

Detail your sales approach, outlining how you’ll convert leads into paying customers․ This includes defining your sales process, pricing strategy, and customer service protocols․ Identify your primary sales channels – will you sell directly to consumers, through retailers, or via online platforms?

Consider a multi-channel approach to maximize reach and cater to diverse customer preferences․ Outline your sales team structure (if applicable) and their respective roles and responsibilities․ Project sales forecasts based on market analysis and marketing efforts․

Clearly articulate your customer acquisition cost (CAC) and lifetime value (LTV) to demonstrate the profitability of your sales strategy․

Funding Request (If Applicable)

Clearly state funding needs and how capital will be allocated․ Detail the use of funds, demonstrating a strategic investment plan for growth and sustainability․

Funding Requirements

Precisely outline the total capital needed to launch or expand your business․ This section should detail the specific amount of funding sought, broken down into categories like startup costs, working capital, and potential expansion expenses․ Be realistic and justify each figure with supporting data from your financial projections․

Specify the desired funding type – debt, equity, or a combination․ If seeking equity, indicate the percentage of ownership offered․ For debt financing, state the preferred terms, including interest rates and repayment schedules․ Transparency is crucial; clearly communicate how the funds will directly contribute to achieving key milestones and generating returns for investors․

Use of Funds

Detail exactly how the requested funding will be allocated across various aspects of the business․ Provide a clear, itemized breakdown, specifying amounts dedicated to areas like research and development, marketing and sales, equipment purchases, personnel costs, and working capital․ Transparency builds investor confidence․

Connect each expenditure directly to projected revenue generation and key performance indicators (KPIs)․ Demonstrate a clear understanding of how each investment will contribute to achieving specific milestones outlined in your business plan․ Prioritize essential expenses and justify any significant allocations, showcasing responsible financial management․

Financial Projections

Present realistic forecasts encompassing income statements, balance sheets, and cash flow statements, demonstrating financial viability and potential for return on investment․

Income Statement Projections

Detailed income statement projections are crucial for demonstrating profitability․ These forecasts should span at least three to five years, outlining projected revenues, cost of goods sold, gross profit, operating expenses (including marketing, salaries, and administrative costs), and ultimately, net income․

Realistic assumptions are paramount; base projections on thorough market research and achievable sales targets․ Sensitivity analysis – exploring best-case, worst-case, and most likely scenarios – strengthens credibility․ Clearly articulate the methodology used to derive these figures, showcasing a deep understanding of the business’s financial dynamics and potential for sustained growth․

Balance Sheet Projections

Balance sheet projections illustrate a company’s assets, liabilities, and equity over a projected period, typically three to five years․ These statements demonstrate financial stability and solvency․ Include detailed forecasts for current assets (cash, accounts receivable, inventory), fixed assets (property, equipment), current liabilities (accounts payable, short-term debt), and long-term liabilities․

Accurate asset valuation and liability assessment are vital․ Ensure the balance sheet always adheres to the fundamental accounting equation: Assets = Liabilities + Equity․ Projecting these elements provides investors and lenders with a clear picture of the company’s financial health and its ability to meet obligations․

Cash Flow Projections

Cash flow projections are critical for demonstrating a company’s ability to generate sufficient cash to cover its expenses and debt obligations․ These projections detail anticipated cash inflows and outflows over a specific period, typically monthly for the first year and annually thereafter․

Separate projections into operating, investing, and financing activities․ Accurately forecasting cash flow reveals potential shortfalls and allows for proactive financial planning․ Investors prioritize positive cash flow, indicating sustainability and the capacity for growth․ Realistic assumptions and sensitivity analysis are essential for credible projections․

Appendix

Supporting documents, like resumes, permits, and detailed market research, bolster the business plan’s credibility and provide further evidence for investors․

Supporting Documents (Resumes, Permits, etc․)

This section consolidates crucial supplementary materials that substantiate claims made throughout the business plan․ Include detailed resumes of key management personnel, highlighting relevant experience and expertise․ Copies of necessary permits and licenses demonstrate legal compliance and operational readiness․

Market research data, such as surveys and competitor analyses, provides evidence for market assumptions․ Letters of intent from potential customers or partners showcase early traction․ Financial statements, including historical data and projections, offer a comprehensive financial overview․ Any legal documents, like contracts or leases, should also be appended, bolstering the plan’s overall credibility and transparency․